Payment gateways are essential for businesses to process payments smoothly and securely. From small startups to eCommerce giants, choosing the right payment gateway ensures smooth payment processing, boosts customer trust, and minimizes transaction issues. This blog takes an in-depth look at the top payment gateways in the USA, their features, benefits, and what makes them suitable for different businesses.

Key Features to Look for in Online Payment Solutions

Choosing the right payment processing solution from so many options can feel overwhelming for businesses. The main goal should always be to ensure smooth operations and a great experience for your customers. To make the decision easier, focus on finding a solution with these must-have features:

- Security and compliance: The first and foremost feature to consider is how well the payment gateway protects your and your customers’ data from fraud, hackers, and breaches. For secure payment processing, Opt for gateways with robust encryption protocols, fraud detection, and compliance with PCI-DSS standards. You can opt for payment gateways that offer encryption, tokenization, and fraud prevention tools, such as 3D Secure, address verification, and CVV checks.

- Integration and compatibility: It’s also very important to determine how easy and flexible the payment gateway is to integrate with your website or app, as well as with other platforms and tools that you use for your business. Ensure the gateway integrates with your eCommerce platform, mobile app, POS system, and accounting software. This flexibility simplifies operations and supports omnichannel payments.

- Multiple Payment Options: As a business, you must ensure that the payment gateway allows you to accept payments from a wide range of customers, both locally and globally. Choose gateways that accept credit and debit cards, contactless payments, digital wallets (like Apple Pay), and emerging methods like cryptocurrency payment gateways. This accommodates varied customer preferences.

- Transparent Fees: Different payment gateways can have different pricing models – flat or tired. You may need to pay attention to various fees like setup fees, monthly fees, transaction cost, currency conversion rates, chargeback fees, and refund fees. Transparent pricing helps control costs and boosts profitability.

- User-Friendly Experience: An interface that is laggy or difficult to use might make the customers fall out due to confusion. To avoid this, you should choose a payment gateway with a simple, user-friendly interface. This makes transactions smoother, reduces mistakes, and keeps customers happy.

Importance of Choosing the Right Payment Gateway

Selecting the right payment gateway solution is about more than just processing payments—it’s essential for running a successful and secure business. Here’s why:

- Enhanced Customer Trust: A trusted payment gateway with robust security features like encryption and compliance with PCI-DSS standards reassures customers that their personal and financial information is safe. This confidence encourages more completed transactions.

- Reduced Cart Abandonment: A smooth, hassle-free checkout process prevents customers from leaving their carts unfinished, directly improving your abandoned cart recovery rate.

- Global Reach: If your business operates internationally, choose a gateway that supports multi-currency payments and cross-border transactions. It simplifies payment processing and makes your business more accessible to global customers.

- Cost Efficiency: Comparing transaction fees and additional costs like chargebacks helps keep expenses in check, maximizing your profit margins.

Comparison of Top Payment Gateways in the USA

Now comes the exciting part! With the comparison parameters in mind, let’s dive into the top five payment gateway solutions in the USA. These platforms have been selected based on their features, usability, pricing, and compatibility, making them stand out as the most reliable options for secure payment processing.

Paid.com

Features and Benefits:

Paid isn’t just a payment gateway—it’s a complete solution for businesses. As an all-in-one platform, it combines website building, cart management, payment processing, and shipping into a unified system. This makes it a perfect choice for businesses looking to streamline operations and improve customer experience.

Fee Structure:

Paid charges 2.89% + $0.30 per transaction.

Compatibility:

Built to integrate seamlessly with websites and mobile platforms, Paid ensures smooth operations for both startups and established businesses.

PayPal

Features and Benefits:

PayPal is widely recognized for its easy integration, global reach, and support for multiple payment methods like credit cards, PayPal Wallet, and Venmo. It also offers buyer protection and advanced security.

Fee Structure:

PayPal charges a transaction fee of 2.9% + $0.30 for domestic sales and higher fees for international payments.

Compatibility:

It integrates seamlessly with popular eCommerce platforms like Shopify, WooCommerce, and BigCommerce, making it a go-to solution for many businesses.

Stripe

Features and Benefits:

Stripe stands out for its developer-friendly API, allowing businesses to create customized payment solutions. It supports subscription-based payments, multi-currency transactions, and cryptocurrency payments.

Fee Structure:

Stripe charges a 2.9% + $0.30 fee per successful transaction and additional fees for international and currency conversions.

Compatibility:

Highly compatible with platforms like Squarespace, Wix, and Magento, Stripe is ideal for businesses seeking customization.

Square

Features and Benefits:

Square is well-known for its easy-to-use POS systems and affordable hardware. It supports in-person, online, and mobile payments, making it versatile for small and medium-sized businesses.

Fee Structure:

Square charges 2.6% + $0.10 per in-person transaction and 2.9% + $0.30 for online sales.

Compatibility:

It integrates with eCommerce platforms like WooCommerce and BigCommerce and offers solutions for brick-and-mortar stores.

Amazon Pay

Features and Benefits:

Amazon Pay provides a familiar and secure checkout experience for customers using their Amazon accounts. It simplifies payment processing with a focus on speed and security.

Fee Structure:

Amazon Pay charges 2.9% + $0.30 per transaction for domestic payments.

Compatibility:

It integrates with various platforms, including Shopify, Magento, and Prestashop, making it a convenient option for eCommerce businesses.

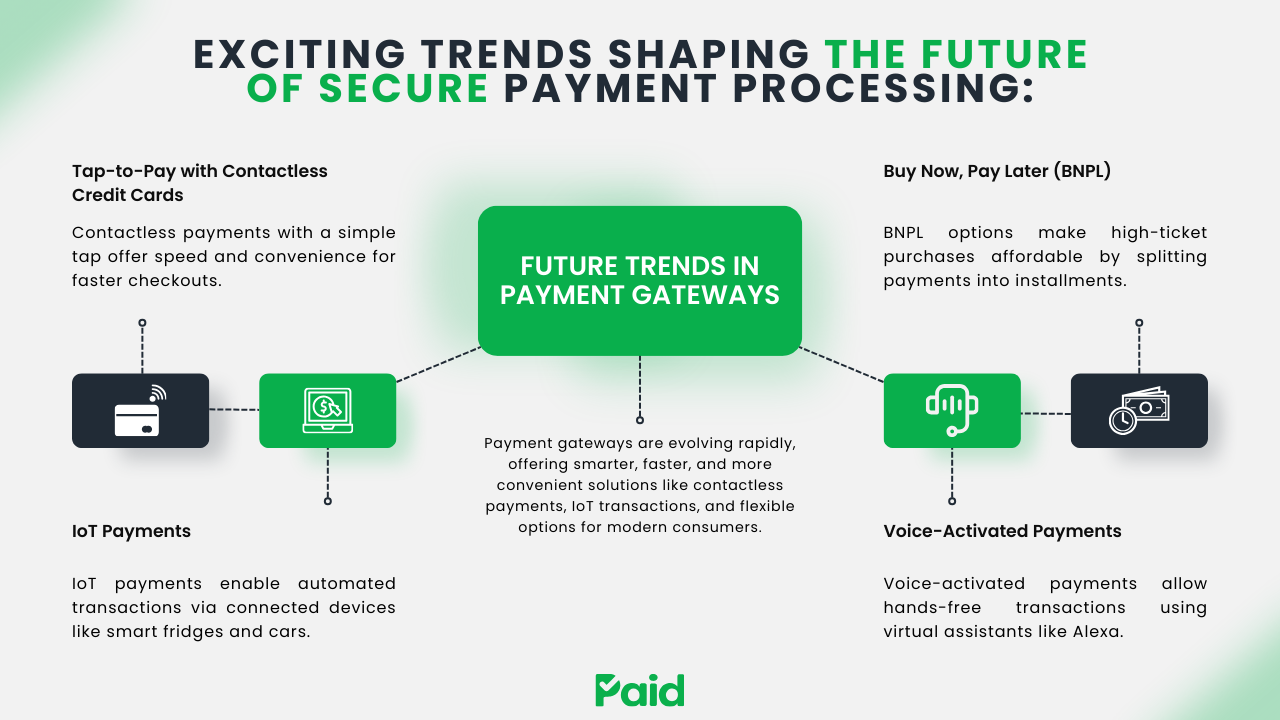

Future Trends in Payment Gateways

The world of payment gateway solutions is rapidly evolving. Every now and then, there are new innovations to meet the needs of modern consumers and businesses. Here are some exciting trends shaping the future of secure payment processing:

1. Tap-to-Pay with Contactless Credit Cards

Contactless payments are becoming a standard due to their speed and convenience. With a simple tap from their mobile phones, customers can pay for their purchases; without inserting cards or entering PINs. This technology ensures faster checkouts and enhances customer satisfaction, making it ideal for retail and quick-service businesses. All the buyer have to do is tap their phones and move on.

2. IoT Payments

The Internet of Things (IoT) payments allow devices to handle transactions automatically without human involvement. For example, a smart fridge can reorder groceries when supplies run low, or a connected car can pay tolls as it drives through. This innovation is convenient for consumers, making purchases quick and effortless.

For businesses, IoT payments streamline operations by reducing checkout times and improving transaction efficiency. This technology bridges the gap between automation and personalization, creating smoother shopping experiences while enhancing customer satisfaction. It’s a glimpse into the future of seamless, data-driven payments.

3. Voice-Activated Payments

Virtual assistants like Alexa and Google Assistant are now capable of initiating payments. By simply speaking a command, users can pay bills, place orders, or even transfer money. Voice payments are particularly appealing for hands-free and on-the-go transactions.

4. Buy Now, Pay Later (BNPL)

BNPL options allow customers to split their purchases into smaller, interest-free installments. This method boosts sales by making high-ticket items more affordable while reducing cart abandonment rates. According to McKinsey, 30% more respondents made the purchase when it was financed by BNPL.

Payments with PAID

PAID is a comprehensive platform designed to simplify and enhance business operations. It empowers businesses by offering tools to create high-converting websites, manage secure payments, and boost customer engagement.

As a robust payment processing solution, PAID also stands out for its focus on secure and streamlined transactions. Built by WebOsmotic, a leader in IT solutions, PAID is tailored to help businesses grow efficiently by converting visitors into customers and building long-term loyalty.

Conclusion

In this article, we learnt the importance of choosing the right payment gateway for businesses. With so many options available, it’s crucial to focus on the features that matter the most – security, compatibility, and flexibility. PAID is redefining how businesses operate by integrating payments, websites, and shipment into a unified solution.

Reach out to WebOsmotic for innovative custom AI solutions, Web and Mobile App Development, UI-UX Design and more.